do nonprofits pay taxes on donations

Changes to sales and property taxes can impact an organizations sustainability for years to come. For nonprofits exemption certificates typically require.

Nonprofits Need To Have An Excellent Board Nonprofit Information Fundraising Methods Personal Fundraising Fundraising

The federal tax code allows individuals and businesses to make noncash contributions to qualifying charities and to claim deductions for these contributions on their tax returns.

. Nonprofits can also sell services or goods to raise money. This only applies as long as you spend the money on your campaign or save it in a fund for future politicking. The exception is private nonprofit schools do not pay sales tax on the purchase of.

Payroll taxes are amounts withheld from your employees wages and paid to tax agencies. Do i need to pay tax on donations that were given to me. However this corporate status does not automatically grant exemption from federal income tax.

If you run for office -- whether its city councilor or president -- any donations to your campaign are tax-free income. This qualification is also necessary to receive tax-deductible donations and many grants. As with any tax form each state has its own exemption certificate and requirements.

Do nonprofits pay taxes. Those states that provide a sales tax exemption. There are some instances when nonprofits and churches are still required to pay taxes.

Changes to income taxes can significantly influence charitable giving leading to more or less. They must pay business and occupation BO tax on gross revenues generated from regular business activities they conduct. While most states wont require nonprofit organizations to pay the.

Sales of food meals beverages and similar items under a number of different circumstances. Donations that others make to nonprofits are generally tax-deductible for those individuals but the nonprofit wont pay taxes on those donations. However they arent completely free of tax liability.

The research to determine whether or not sales tax is due lies with the nonprofit. We Ensure The Proper Procedures Policies Are In Place At Your Nonprofit Organization. View solution in original post.

For nonprofit organizations tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. They must pay sales tax on all goods and retail services they purchase as consumers such as supplies lodging equipment and construction. Donations to pay someones medical or educational expenses are not.

Those purchases become part of the total amount that is subject to tax. Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

The sales tax exemption certificate proves to the seller that the buyer is a legitimate nonprofit and not required to pay sales tax. A nonprofit can sell goods and often this is completed through donations or grants. Do non profits pay taxes on donations January 3 2022 At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite.

The mere words tax policy may put some people to sleep but small changes quickly add up to big impact on nonprofits bottom lines. For example if you receive bonds as a gift you must report any interest the bonds earned after you received them. But if you make a 10000 tax-deductible donation to the government you will only be taxed on the 40000 you have remaining and thus you will only owe the federal government 8000 instead of 10000.

Recipients do not report them on their taxes. Some nonprofits are exempt from paying certain payroll taxes. Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare just like any for-profit company. RAB 2016-18 Sales and Use Tax in the Construction Industry. Gifts or money you received as a present isnt taxable but you do owe taxes on any income it produces.

The only way to see a tax benefit from charitable contributions used to be through itemizing the tax returnlisting each of those donations one by one. Payroll taxes for tax-exempt organizations work a little differently than non-exempt businesses. If you receive 7000 in your city council campaign spend 5500 and pocket the rest thats 1500 in.

Ad Over 3149 Successful Tax Filings for Nonprofits of All Shapes Sizes. What Does a Nonprofit Do. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount.

Any nonprofit that hires employees will also need to pay employee taxes like Social Security Medicare and in some cases Unemployment Taxes. These organizations receive income tax exemption and their donors may take a tax deduction for their donations. Even though the federal government awards federal tax-exempt status a state can require additional documentation to.

Nonprofits that qualify under section 501 c 3 of the IRC become exempt from paying federal income taxes. The purpose of a nonprofit is to serve the public. This may be through offering goods to the community or providing services that are needed by the local population.

In Washington nonprofit organizations are generally taxed like any other business. Nonprofit missions and. Entitys sales tax registration number.

In general a person can give any individual a certain amount each year without triggering gift tax. If the nonprofit has paid staff the organization must cover the employers portion of their Social Security Medicare and unemployment taxes. Now the new tax act has raised the standard deduction from 6350 to 12000 for single individuals and from 12700 to 24000 for married couplesalmost doubling the standard deduction.

In short the answer is both yes and no. The most well-known tax designation for charitable nonprofits is 501 c 3. To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to.

5 Certain other organizations may also receive tax-deductible. Although donations received prior to the nonprofit qualifying for tax-exempt status are not tax deductible they become retroactively deductible. Because the donation you made was tax-deductible 2000.

Tax Information on Donated Property. Consider that educational institutions and hospitals are nonprofit organizations but still sell services or goods. If so the payment will result in taxable income for the nonprofit.

They are membership-based organizations and membership dues are not tax-exempt. In most states nonprofits are also responsible for paying the sales tax or using a tax on their purchases and charging the sales tax on their sold items. The IRS will look at the payment made to a nonprofit by a corporate sponsor and decide whether the payment is a tax-free gift charitable contribution or a taxable advertising paymentThe IRS focuses on whether the corporate sponsor has any expectation that it will receive a substantial return benefit for its payment.

Gifts of donated property clothing and other noncash items have long been an important source of revenue for many charitable. Your recognition as a 501c3 organization exempts you from federal income tax. This only applies as long as you spend the money on your.

Gift taxes are the responsibility of the person giving the gift. Normally if you do nothing you will owe the federal government 10000 in taxes. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

As of 2014 that amount was 14000. Read on to learn about nonprofit organizations tax-exempt nonprofits and nonprofit payroll taxes. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for.

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Sponsorship Levels

Non Profit Donation Letter For Taxes Google Search Fundraising Letter Non Profit Donations Donation Letter

Charitable Donations H R Block Best Time To Study Credit Card Infographic Infographic

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

A Brief History Of Charitable Giving Visual Ly Charitable Giving Infographic Charitable

Small Businesses Charitable Contributions And The Irs Signify I Marketing For Nonprofits And Social Enterprises Small Business Business Tax Conscious Business

The Inspiring 10 Treasurers Report Template Resume Samples For Fundraising Report Template Photo Below Is Other Budget Template Budgeting Budget Spreadsheet

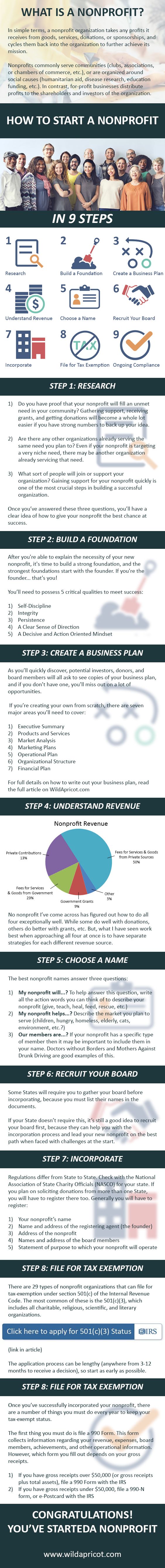

How To Start A Nonprofit In 4 Parts Nonprofit Startup Start A Non Profit Nonprofit Management

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Non Profit

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

How To Make Giving Levels Work For Your Nonprofit Writing Supplies Summer Learning Camp Fundraiser

How To Start A Non Profit Organization In Pennsylvania Paperwork Cost And Time Http Localhost Inform Start A Non Profit Non Profit Nonprofit Organization

Step By Step Guide To Wrtiing Your Corporate Sponsorship Proposal Sponsorship Proposal Sponsorship Letter Donation Letter

Non Profit Budget Budget Template Donation Letter Template Budgeting

Sponsorship Levels Event Sponsorship Donation Letter

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

Social Fundraising Tools For Nonprofits Causes Nonprofit Startup Fundraising Marketing Fundraising Activities